RBANKING : Loans Department

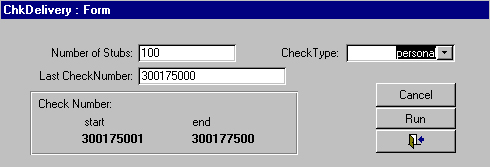

The loans module of the RBanking software allows users to quickly process and manage loans. At a click of a button you can :

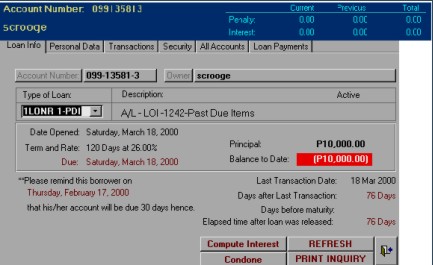

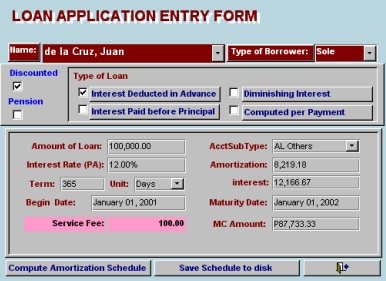

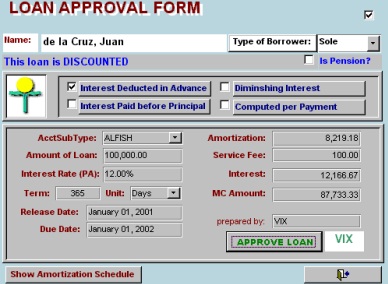

- Prepare a schedule of payments.

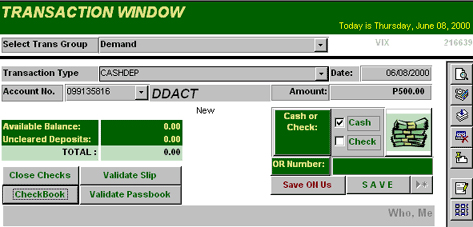

- Make payments for loan accounts.

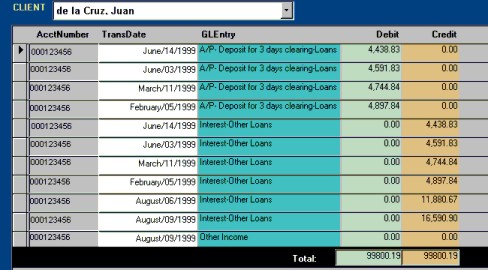

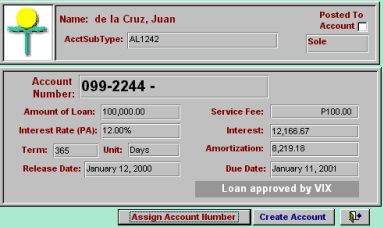

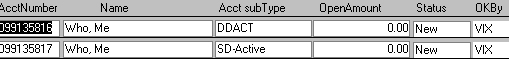

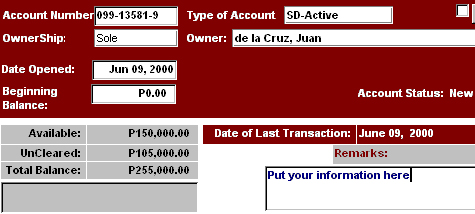

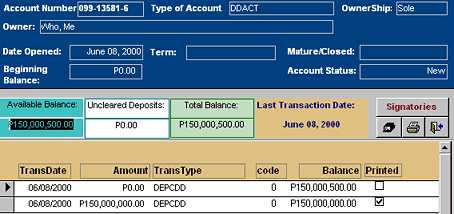

- View all pertinent details of a client’s account, from transactions to a list of all other accounts with the bank.

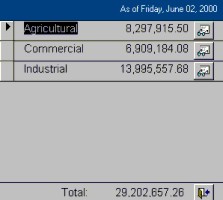

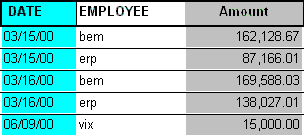

Generate reports for loans approved and released along with charts showing the distribution of releases. Prepare notices and reminders quickly. These can be printed individually or by batches according to the dates desired.

MAIN MENU

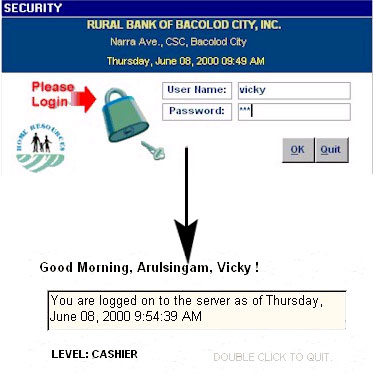

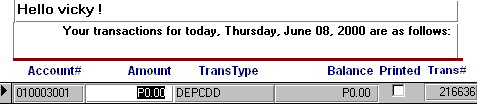

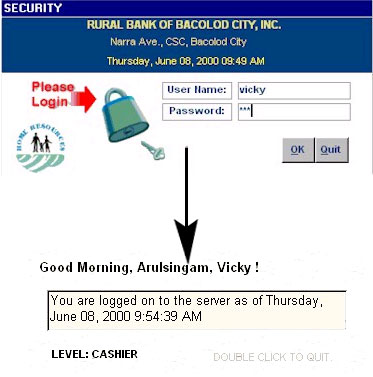

Access to functions in the LOANS program is determined by user log in. For example, new employees are restricted to only accepting applications for new accounts and selling heckbooks; while others have rights to enter transactions. The security module embedded in the program allows managers to control the transaction amount allowed to certain employees.