MODULES : Point of Sale

A network-ready sales management system for recording sales and monitoring inventory. Provides secure access and audit trails for each transaction. This system includes warehousing and basic accounting as well as real-time reporting on sales and other activities.

FEATURES

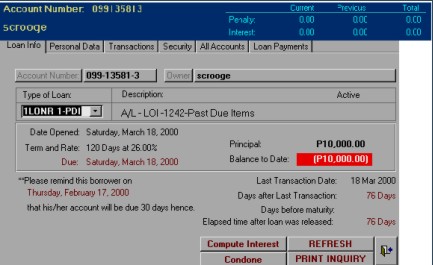

- Sales recording for cash and credit

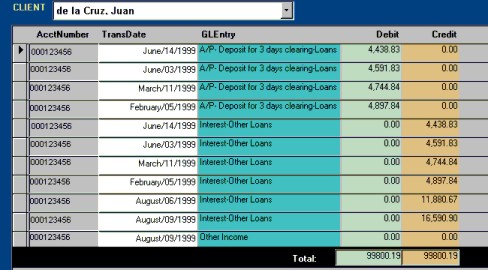

- Account statement preparation

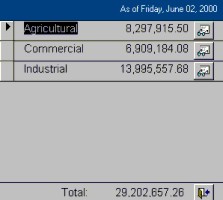

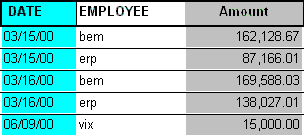

- Sales reporting by date, department, product category and shift

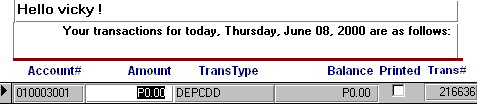

- Individual sales transactions for accounting audit

- Purchasing and receiving of items

- Materials inventory and information on barcodes, price and pricing trend.

- Locator inventory monitoring

- Transfer and return of items from locators to warehouse

- Item returns to suppliers

- Reporting on accounts payables and receivables

- Record disbursements

- Trial Balance

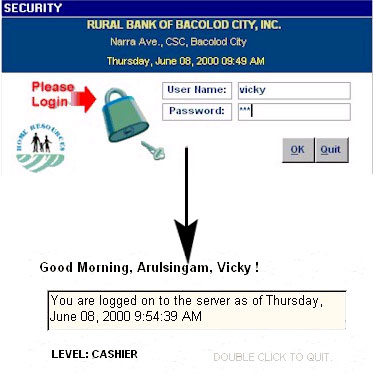

- Multi user access

- Secure logins