RBANKING : Transactions

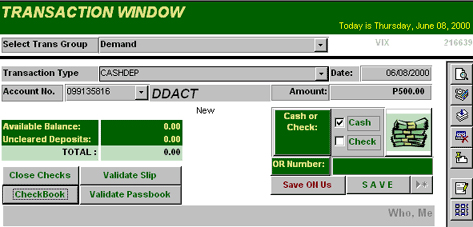

Transaction Window

Save transactions and validate slips and passbooks after completing a transaction.

Fields

- Select Trans Group:

Limits the list of transaction groups presented in the droplist. Describes a range of accounts and transactions - Transaction Type:

A name given to a certain transaction with a corresponding entry in the ledgers of the bank. If the transaction type is not

explicitly defined in the bookkeeping rules, the user must post to the general ledger.

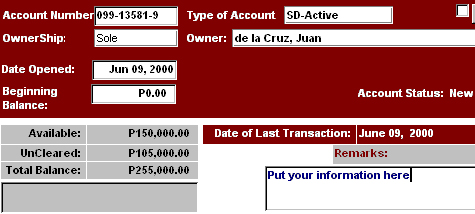

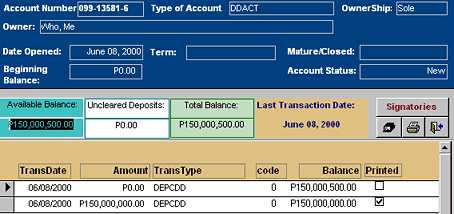

* After selecting an account, account details such as name, total deposits, uncleared deposits, and available balance are displayed

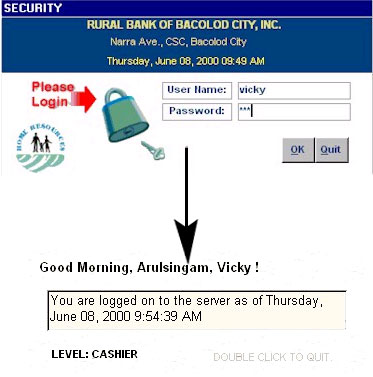

*An override notice is given when a transaction requires the approval of another bank employee